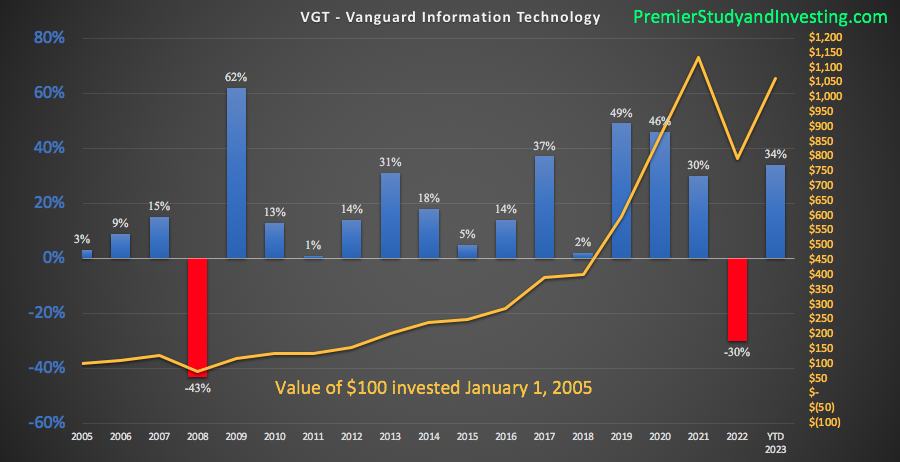

If this is your first time looking at the past performance of Vanguard’s Information Technology ETF, you might be as shocked as I was. From 2005 to 2023, it has two losing years. The other years have seen dramatic gains.

VGT was often chosen by the portfolio optimization model in 2023, because of its average returns over the last five years. When I took time to consider the fund, I had already missed the run up fueled by the AI excitement. Should 2024, be a hard landing as many, including DoubleLine’s Jeffery Gundlach are predicting, then I am hoping to add more VGT, hopefully buying the bottom.

One of the reasons this makes sense to me, was how the CFA level 2 lectures discussed US growth being tied to improvements in productivity. While capital elasticity and growth in labor supply are also critical to economic growth, the program left a strong impression about the power of increases in output through innovation. The innovations, that hopefully occur with tech firms, can improve per capita output in countries that have previously been sufficiently capitalized.