Despite recent Federal Reserve decisions to increase the bench mark interest rate, inflation is still running red hot. It is theorized that when strong demand for goods and services continues to push prices higher; central banks can cool off an economy and regain stability in prices by raising interest rates. This makes sense as there would be less borrowing leading to less spending and more encouragement to save since consumers could invest their money at higher rates.

Concerning this inflation problem, CNBC posted on October 13th, 2022, “Consumer prices rose 0.4% in September and were up 8.2% from a year ago… excluding food and energy, the core consumer price index accelerated 0.6% and 6.6%, respectively. The yearly gain for core was the highest since August 1982.” So let’s not kid ourselves here, we just witnessed a 40 year high-water mark on inflation. The stock market surely noticed as the following day saw the S&P 500 drop below $3,600.

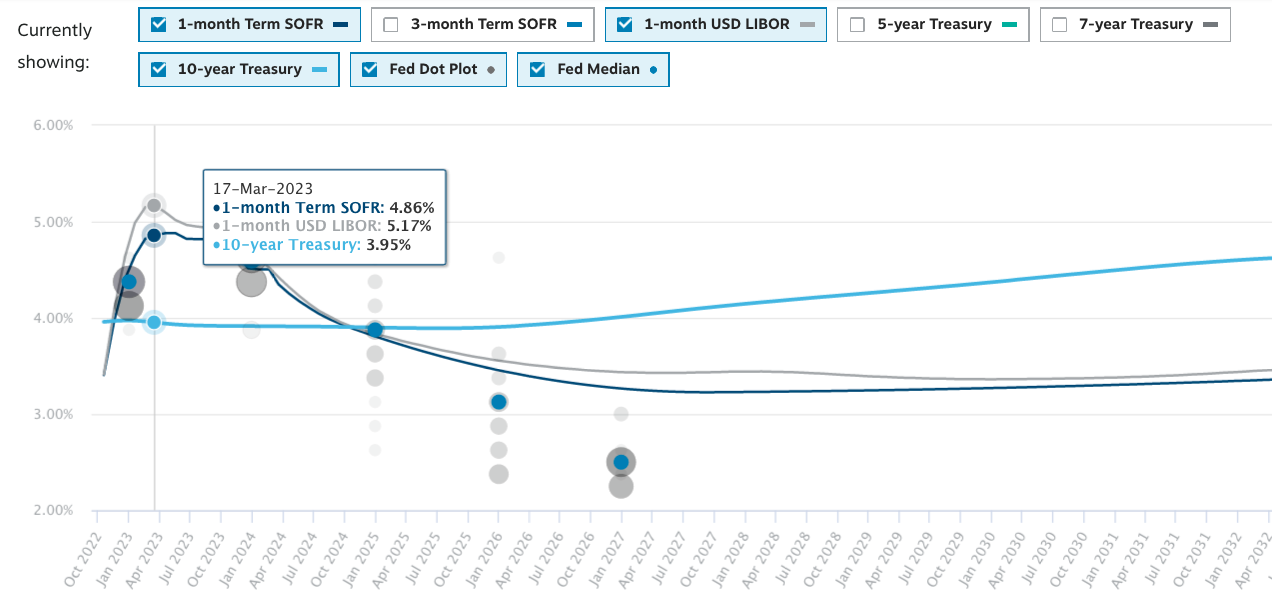

Many have speculated that the Fed will increase the federal funds rate by 75 basis points, equal to 0.75%, in November and are likely to continue a similar trend into 2023. We note that that rates are forecasted to go higher. So how can investors manage such times with stocks in a downward slide?

![]()

One way to approach investing at this time is to simply take a short term CD, or Certificate of Deposit, and lock in an annual rate of around 4%. These can be purchased through a standard brokerage account. Another approach is to be patient in order to take a bigger position in CDs at the end of the Q1 2023, when Chatham forecasts short term rates will be at their highest.

If you find yourself to be an impatient trader and you expect rates to go higher over the next three or four months, you may be interested in an inverse bond ETF similar to the TBF, an inverse Bond ETF that does not use leverage. A similar but higher risk ETF would be the TTT, an 3x inverse bond ETF, might also be of interest. A note of caution is that leveraged ETF’s are derivatives products that do not perform like unlevered ETF’s. Be sure to read the summary prospectus to be aware of the special nature of these products. The TBF, TTT, or other inverse bond funds will see its price rise as interest rates rise and as bond prices fall. Year to date the TTT is up over 160% due to the effects of leverage and the dramatic increase in interest rates in the US bond market in 2022.

We can also see that based on the forecasts, these short term CD’s would provide a higher coupon than the 10-year treasury, which carries higher risk due to increased interest rate risk. So you may hear that buying the longer dated bonds is unwise.

But hold on one second. Some investors may attempt to play the interest rate risk to their advantage by buying long term bonds with their higher duration. Duration figures are generally found on brokerage platforms or investing websites for various bond ETF’s or specific bonds. Duration is simply a measure of sensitivity to the change in a bond’s price given a 1% change in interest rates. For unseasoned investors, the thing to remember is that duration affects the price of bonds in both directions, as rates rise and also when rates fall. Some investors may be waiting for the much talked about, “Fed Pivot” when the Federal Reserve decides it is time to drop interest rates which would result in bond prices going up. If the bond market did see the federal funds rate begin to fall, then the price appreciation on bonds with high duration could contribute to a appealing return. How appealing? A non-inverse bond ETF with a duration of 7, would see an increase in price of 7% for every 1% drop in interest rates. While the high duration strategy might work beautifully, the question is one of timing. The recent FOMC minutes put out by the Fed seemed to suggest that the Fed was intent on pursuing a target inflation rate of 2% by continuing to raise interest rates into the future as needed. If inflation numbers continue to stay high and unemployment low, then rate increases may continue further into 2023 and could remain elevated into 2024 as we notice in the Chatham Capital chart that short term rates are not expected to drop significantly until Q1 2024.