Last Updated April 28, 2022.

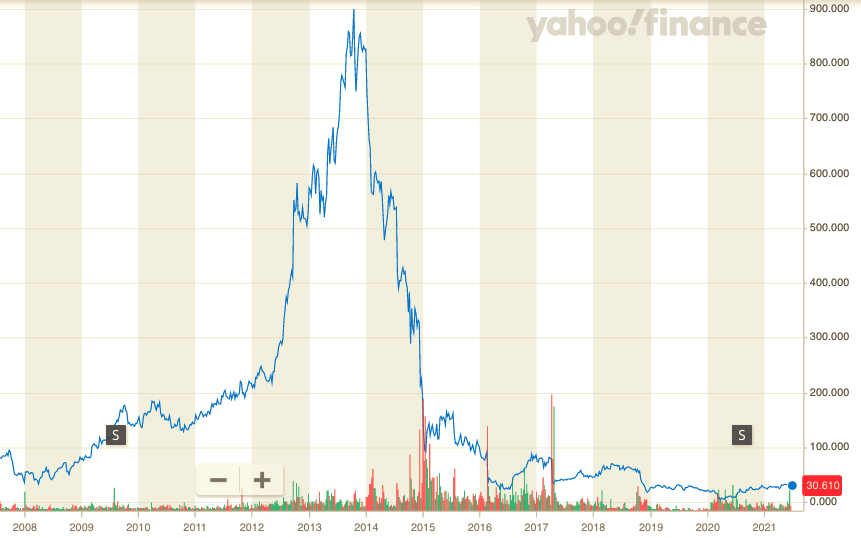

Since the making of the video below, Ocwen had risen to over $40.00 by the beginning of 2022, an increase of approximately 95%. However, it gave back all those gains in the span of four months, as the stock price was cut in half by mid-April 2022.

Ocwen is a servicer of sub-prime mortgages. The share price increased dramatically during the aftermath of the housing crisis of 2008. With the landslide of foreclosures from 2009-2012, Ocwen shares increased dramatically as in 4X the share price (see graphic below). I was expecting a huge run up in the share price during the lockdowns of 2020, but the mortgage moratorium was able to keep a significant number of people in their homes.

At of the end of April 2022, tech stocks have taken a beating. Many pundits are talking of a 2022 or 2023 recession. With US GDP falling 1.4% in Q1 2022, perhaps Ocwen is well positioned to do the dirty work of cleaning up the next housing bust.