******

Prior to December 2024, Yahoo Finance provided free downloads for stock prices, but since that time they began charging $40/mo. for data that has been free for years. There are two solutions to this:

1. You can pay $10/mo. through https://stockanalysis.com and be able to download prices for nearly any stock or ETF that you want to consider for your portfolio, or

2. I provide a quarterly Excel model that would be the final product of taking this course, however it only includes the suggested ETF’s listed below. I recommend going to the bottom of the page and downloading an older model to see what the final product is like. If you decide to download the finished Excel Model from me, you can do so at:

https://www.patreon.com/c/user?u=89855564

******

It is admirable to learn something new like investing. So here is a question, what is the difference between buying stocks randomly versus building a portfolio?

Think about it, what is a portfolio of stocks and bonds?

Does it make sense to define a portfolio as:

#1. doing limited research and/or applying emotions about the future and then

#2. buying a random number of assets (5, 10, 25, or more) and

#3. guessing if we should overweight some assets and underweight others or perhaps put equal money into each asset?

Investing based on news headlines and guessing is a problem.

Most people want a better strategy. What should we do?

We are left with a choice. We either:

A. pay a financial advisor to manage our money for an outrageous fee

B. buy a random list of stocks and put more money in the ones we feel good about, or

C. learn portfolio management.

Most investors typically pay a 2% annual fee to a financial advisor because they don’t understand that this ends up costing a single Roth IRA (a retirement account) $600,000 of lost returns over 30 years (video on that below). $600,000 is a house. $600,000 is a legacy.

Other investors, including myself, start out managing our own money (good for us!) by buying a mixture of random shares based on news headlines (not so good).

I was taught Modern Portfolio Theory in graduate school and want to teach it to you as a third option – to calculate the returns of stocks and bonds over the last five years and use Excel to create a personalized portfolio tailored to your goals. We want to move from feelings and assumptions to a mathematical estimate of what we are buying. Using five years of data, you can capture how assets perform within different political environments, interest rate environments, periods of greed, and periods of fear.

Do you want to aim at a certain annual return (5%-19%) with the least risk as possible for that desired return? Good, you will learn how to design a portfolio with an expected return.

Do you want to understand the exposure to losses you are taking? Great, you will learn how to measure your risk exposure.

In my opinion, having a mathematical answer for these questions instead of guessing at what to buy is the reason Modern Portfolio Theory won a Nobel Prize in 1990. Finance students worldwide are still paying $300-$3,000 to learn Modern Portfolio Theory at a university.

But managing our own money sounds scary, right?

I agree. So, let’s take some courage from Warren Buffett and Charlie Munger from Berkshire Hathaway about financial advisors.

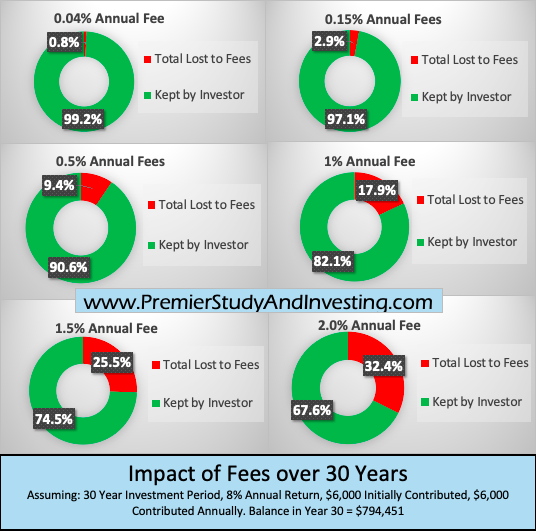

The annual fees going to financial advisors devour a lot of our returns. Notice the red sections are taken by fees, leaving you with the green. Often anyone who manages your money take 1% to 2% or more in fees every year!

The graph shows that if you put $6,000 per year into a retirement account, and avoid paying 2% in fees, then you will pay yourself $257,180 over 30 years. With the dollars saved by avoiding fees we could buy a house in many parts of the world!

At the same time, Warren Buffett does not put 100% of his money in the S&P 500 index. He was speaking as we do in finance, about the S&P 500 as a measuring stick to compare other portfolios against. Further down in this article I give you a list of funds that you might want to include in your list of possible investments. I include the S&P 500 in my list of assets under consideration and have found that over the last few years using Modern Portfolio Theory, there are usually better combinations than buying the S&P 500. However, we will consider it in our model to protect us from the nagging questions of, “Yeah, but is my portfolio better than just buying the S&P 500 benchmark?”

One reason to avoid holding only the S&P 500 is to stay away from certain companies that are believed to be unethical. Second, only holding the S&P 500 is a fairly high risk strategy. Third, you may want to build a portfolio around a core company/sector if you have a strong confidence in one or two areas. For example, let’s assume an investor has a strong belief about the future of uranium in energy production. We could create a rule that puts 20% of their overall portfolio in Uranium and then ask Excel what would be the best assets for the remaining 80% of the money to be invested. Excel can calculate the best combinations of assets based on the rules we provide. It all depends upon the last five years of price action, the assets you include in your list of possible investments, and if you decide you want to dedicate a certain percent of your portfolio to a specific strategy, like uranium. If you want to see the end product, find the download button at the bottom of this page for a basic excel model that allows you to experiment with creating rules using the functions in Excel.

Some investors know they want to have a significant position in Uranium, Tesla, Nvidia, or a Crypocurrency. Other investors are happy to hold any stocks and bonds as long as the expected return and risk level are acceptable. Check out the free lesson #1 video below for a conceptual overview of what you will be doing.

A typical Master of Finance program will discuss the extensive academic research that shows how actively managed funds (the ones that charge you the high fees) are rarely able to outperform passive investing. The reason we will look at buy and hold strategies (i.e. passive investing) is because you already have a busy life and you do not need, or want, to spend multiple hours a week constantly monitoring stocks throughout the day. A buy and hold strategy is designed to build a portfolio that requires minimal maintenance. This is why we call it a passive strategy.

Some common questions investors have include the following:

Which stocks do I want to buy?

What combination of my stocks work best together?

Should I invest more money in certain stocks? If yes, what are the right percentages to assign to each asset?

How can I make a portfolio that is designed to hit my desired returns without being overly exposed to losses?

Am I a high or low risk investor, how can I measure this?

How can I calculate the riskiness of the portfolio I created?

How can I build a manageable portfolio of approximately five to ten assets so that I don’t have to track an overwhelming number of companies?

As time goes on, how can I update my portfolio so that it continues to meet my risk and return goals?

What If I don’t have a background in mathematics or finance?

I will be covering all of these questions in this course. I will give you every formula and show you how to enter it properly in the videos and with the Video Partner Excel sheet provided with the course. I want you to feel confident in how this works. So, we will start with the theory and then go step by step in Excel to come up with the amount of money to put into each asset. Once you understand the steps, you will be able to make adjustments at any time, including when you rebalance your portfolio.

You may find you enjoy having a hobby that makes you smarter and hopefully richer. However, even if you decide to have the professionals manage most of your money, at the very least you will have a better understanding of what they should be doing with your funds.

Included in the course:

- 20 Video Lessons (total run time of 3 hours) that walk you through each step of the process.

- A “Video Partner” Excel file that is the same file that I am using in the videos. This allows you to click into the cells and see the formulas for the portfolio being build in the videos.

- A Portfolio Creation Template to jumpstart the process of creating your own portfolio using the assets you want to consider. It has notes, comments, and directions that help you stay organized and enjoy the process.

Let’s start making a list of possible stocks and funds to consider for your portfolio

Once you have access to the course you also need a list of possible assets for investing. Since there are 10,000+ companies, below I provide a list of ticker symbols that cover a large portion of the market, including ETF’s for each of the eleven sectors that make up the stock market. ETF, stands for Exchange Traded Fund. So these are funds, or a basket of shares of many individual companies, that are based around a theme such as healthcare, technology, or even a region like Europe. Thousands of ETF’s have been created around many themes, including gold, bonds, and Bitcoin. We use “tickers” like XLE as a letter code rather than typing out the entire name of a fund. XLE is the ticker for the Energy Select Sector SPDR Fund. You will use tickers when you place buy or sell orders in your brokerage account.

One note about ETF’s and shares purchased through a brokerage account is that you can always sell shares once they settle (typically two business days after the date of purchase) if you decided you changed your mind or need to convert those shares back to cash.

Here is a starter list of tickers that covers the basics. Remember these are ones we are going to put into consideration, but not necessarily going to buy.

XLE – Energy, mostly related to oil and gas

XLB – Materials

XLI – Industrials

XLY – Consumer Discretionary (Refrigerators etc.)

XLP – Consumer Staples (Everyday Goods)

XLV – Healthcare

XLF – Financials

VGT – Information Technology

VOX – Telecommunications

XLU – Utilities

VNQ – Real Estate

EMXC – Emerging Markets without China

GLD – Gold

GBTC – Bitcoin

SPY – S&P 500 ETF

VTI – All United States Equity/Stock Fund

PGHY – High Yield/ High Risk Corporate Bond ETF

VWEHX – Lower Yield / Lower Risk Corporate Bond ETF

BIL – 1-3 Month US Treasury Bond ETF

TLT – Long Term US Tresury Bond ETF

Feel free to add more stocks or ETF’s after doing some research on a site like https://etfdb.com/etfs.

∞ You might want to download a simple excel sheet with 2023 prices to see how to create different rules and change the expected return for a portfolio using the tools in Excel. The download is free (see below) and inside the excel file is a link to a tutorial on how to use the Solver function in Excel.

∞ This course has a $39.00 one-time cost.

∞ Stripe payment processor will send you receipts to the email address you choose, but we do not require that you confirm your email address nor do we run email adverting. We chose a one time payment rather than a monthly subscription service to avoid disputes over ongoing monthly charges. If you have any payment disputes you can contact Stripe at https://support.stripe.com/questions/disputing-a-purchase-made-through-strip

Vanguard’s founder, Jack Bogle sounded crazy when he said 63% of gains are lost when we pay a 2% annual fee over 50 years. Here’s the math. It’s still hard to believe he was right, but he was!

Free Lesson #1 – Let’s Look at the Concept of Modern Portfolio Theory

Still considering an investment in your investing knowledge? No problem, let’s take a look at lesson #2 from our course to see how you will start building your portfolio based on the stocks, ETF’s, and bond funds you consider possible investments.

Play Video